A recent report from IBM and the Ponemon Institute proves that, once again, the cost of data breaches for banks is on the rise. In fact, the report showed banking second only to healthcare in both the number and average costs of data breaches. In 2022, the average cost of a data breach in the financial sector was $5.97 million, up from $5.72 in 2021. Costs for detection and escalation are up by 16 percent, as banks struggle to keep pace with hackers that are using sophisticated phishing, social engineering, and Ai-assisted hacks to gain valuable customer data.

Staying One Step Ahead of Hackers

A decade ago, the majority of financial cyberattacks were designed to steal information, such as credit cards, PINs, and passwords. Today, the attacks are more destructive, aimed at crippling businesses and disrupting operations. In 2021, the banking industry experienced an increase of 1,318% in ransomware attacks, according to Security Magazine. Attacks are predicted to increase by roughly a rate of 15 percent a year for the near future. In fact, Cybersecurity Ventures reports that cybercrime will account for more than $10.5 trillion in theft by 2025—making it the world’s third-largest economy right behind the US and China.

As bad as that is, there’s still good news to be found in the banking cybersecurity world. Deploying advanced cybersecurity tools can not only decrease your likelihood of getting breached, but once a breach occurs, advanced tools can shorten the time to detection and containment. This is particularly true when your monitoring tools employ AI. The extra firepower that comes from AI-assisted tools can shorten your event window considerably. If you can manage to keep your containment window to less than 200 days, you can shave 26 percent of your breach costs.

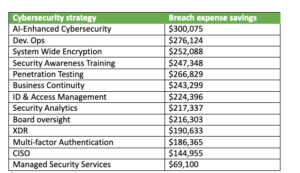

Consider this chart from the report, which breaks down exactly what different tools can do for your breach containment exposure.

How Much Cybersecurity Strategies Lower Your Costs During a Breach

The IBM/Ponemon report took a look at the various types of interventions that a company can take, and how much those cybersecurity tools can save you in the event of a single data breach. Ideally, of course, a security tool will help prevent a breach from occurring. But, even if the worst happens, the tools can still come to your rescue.

Why? Because they help you detect the threat earlier. Every day you’re able to shorten the detection and remediation process is a day you lower your expense and exposure. All these tools and strategies are ones we sell and recommend. Using them pays off, in more ways than one.

Keeping Your Digital Banking Convenient and Safe

The coronavirus pandemic has accelerated the banking industry’s digital transformation and completely changed consumer behavior. Consumers are increasingly choosing cashless payment alternatives using digital banking platforms, such as mobile apps and web portals.

These digital solutions create new vulnerabilities, including insecure data storage, insufficient authentication, and direct code tampering. These, in turn, put consumers at risk for exploitation by cybercriminals using techniques such as app-based banking trojans and fake banking apps.

To keep up with consumer and payment trends and avoid major security risks, banks must invest in cybersecurity practices for mobile and web platforms.

How Safe Are Your Third-Party Services?

By nature, banking is a highly collaborative business. Third-party vendors help financial institutions access expertise or improve efficiency, enabling them to remain competitive in the industry.

Third parties and their cybersecurity practices must be carefully monitored to avoid vulnerabilities, which could expose critical infrastructure to threats. The APIs used by banks must also be carefully examined to identify and prevent potential risks associated with third parties.

AI—Your Best Cybersecurity Friend

Artificial Intelligence (AI) techniques have been used by major banks for years to detect deviations and anomalies. But AI is now playing a crucial role in customer behavior monitoring for fraud detection and prevention.

It also improves risk management, as AI-powered solutions can analyze data in massive volumes and quickly spot patterns from several channels. This helps predict and prevent credit risks and can also identify malicious acts, such as identity theft and money laundering.

Understand Your Business—Understand Your Risks

Making cybersecurity a priority is no longer simply a safety measure tactic for your IT health. It’s now incumbent on banks and financial institutions to make it a critical business initiative. It must be a part of annual business budgeting discussions and overall strategic planning. This is not just the opinion of a few experts. It’s a recommendation from state and federal banking regulatory bodies.

At Integris, we’ve designated a significant portion of our workforce to managed IT services for community banks and credit unions. We have a specialized line of productivity and cybersecurity tools for financial institutions, too. Interested in learning more? Check out our online resources, or schedule a free consultation today!